2CGM Knowledge - Jan 23

Check out the latest Knowledge posts from 2CGM Leaders:

by Nick Porcaro, Associate Creative Director

Industry updates

Ad Vendors / Platforms / Data

-

Google's parent company Alphabet is cutting about 12K jobs, or 6% of its workforce. Microsoft will also shed 10K jobs, less than 5% of its workforce, and will focus on imbuing its products with more AI going forward. (Reuters)

-

Microsoft plans to incorporate AI tools like ChatGPT into all of its products and make them available as platforms for other businesses to build on. It will be giving more customers access to the software behind Open AI tools through its cloud-computing platform Azure. (WSJ)

-

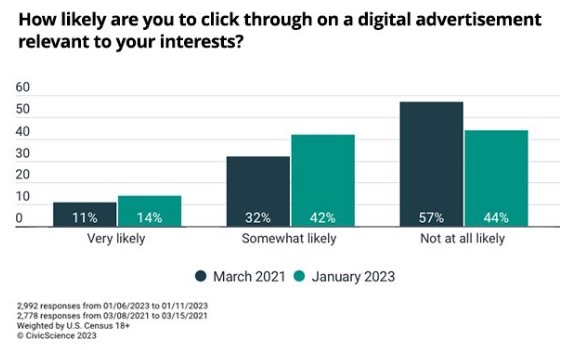

US consumers believe digital ads they see are becoming more relevant, although companies like Apple, Google and Facebook are using less personal data to target ads. The number of US adults who say digital ads they see are at least somewhat relevant to them has climbed from 30% to 41% during the past two years. (Media Post)

-

Pathmatics named Facebook the most popular social media platform for top Australian digital advertisers, with the top 20 brands committing 63% of their social budget compared to Instagram (27%), TikTok (7%) and Snapchat (3%). (Media Week)

-

Almost all of the user growth amongst US teens online is going towards short-form video apps. To build an audience, creators should lean into viral video trends — even if they aren't video professionals. (Axios)

-

Google is removing redundant keywords across different match types. Currently, one of Google’s auto-applied suggestions allows the system to remove redundant keywords of the same match type within the same ad group. (Search Engine Journal)

Awards / Festivals

-

Netflix is leading the distributor pack at the EE BAFTA Film Awards with 21 nominations, 14 of which are for All Quiet on the Western Front. Searchlight and A24 were not far behind with 14 nominations each. (Variety)

-

Avatar: The Way of Water dominated the 21st annual Visual Effects Society Award nominations, earning 14 nods, a record number for a feature film or any single project in the society’s awards history. (THR)

-

The 2023 Critics Choice Awards saw decreased viewership YoY - 900K viewers this year compared to 1.1M in 2022. The dip in audience tune-in this year falls in line with every other awards show telecast losing viewers over the past few years. (Deadline)

Cinemas / Theatrical

-

Avatar: The Way of Water has generated $1.938B globally, overtaking Spider-Man: No Way Home ($1.91B) as the sixth-highest grossing release in box office history. Avatar's next major hurdle is crossing $2B, a feat achieved by only five films in history. (Variety)

-

Atomic Monster and Blumhouse officially announced a sequel to M3GAN, the horror film that opened January 6th. The sequel, M3GAN 2.0, will be released January 2025. (THR)

-

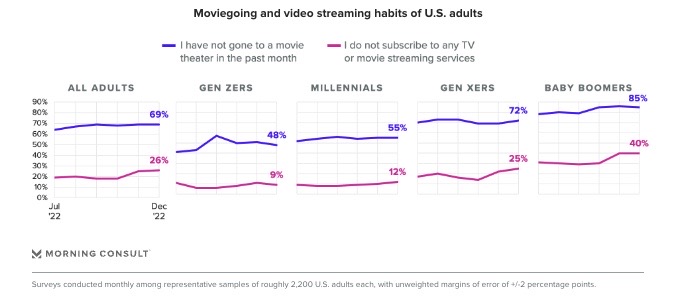

As of December, 72% of US Gen Xers and 85% of US Baby Boomers had not been to a movie theater in the past month, far higher than the equivalent figures for Gen Z adults (48%) and Millennials (55%). (Morning Consult)

-

As of December, 31% of US adults “somewhat” or “strongly” preferred the movie theater for new releases, up 2 points from July. The preference for theater releases could inch upward through 2023 as more big-budget films are expected to hit cinemas this year compared to 2022. (Morning Consult)

-

IMAX is adding 7 new theaters in Japan, having nearly tripled its network there over the last decade thanks to Hollywood blockbusters and Japanese anime. (THR)

-

China appears to be lifting its de facto ban of Marvel films, with Black Panther 2 and Ant-Man 3 getting February release dates. They will be the first Marvel titles to show in China since 2019’s Avengers: Endgame. (THR)

Gambling / Casinos

-

Nevada casinos reported net income of a record $4.12B in 2022 fiscal year as income from gaming, hotel rooms, food and beverage, and entertainment all hit a new high. (Casino.org)

-

FanDuel and DraftKings got approval for temporary sports betting licenses in Massachusetts. The approval came just two weeks before in-person betting was scheduled to launch. (Masslive)

-

Holland America, an American-owned cruise line, announced an expansion of the casino space on some of its ships. The company plans to add more machines, enhancing the experience for its casino-loving passengers. (Gambling News)

Live Events / Attractions

-

AMC Networks will host an in-person event with 200-250 guests during the spring upfront season. The event, slated for Tuesday, April 18, at New York’s Jazz at Lincoln Center, will resemble last year’s pitch to advertisers at Peak. (Deadline)

-

A new theme park called Roboland opened in Orlando, Florida. The park features robotic animals, more than 30 interactive exhibits, food made by robots and other glimpses into the future of technology. (Fox)

-

Splash Mountain at Disney's Magic Kingdom officially closed for renovations. The new ride will be called Tiana’s Bayou Adventure, based off the 2009 movie The Princess and the Frog. (Click Orlando)

Music / Audio / Podcasts

-

TikTok is testing a new "Podcasts" feature that allows users to listen to audio in the background. The functionality enables a user to do other tasks on their phone during playback. Ordinarily, moving away from a TikTok video pauses it outright. (Insider)

-

The number of new podcast shows that debuted in 2022 was down 80% since 2020. The number of new shows in 2022 was even lower than pre-pandemic levels: 337K podcasts were launched in 2019, compared to 219K in 2022. (The Verge)

-

The Top 10 hits in the US last year accounted for fewer than 1 in every 200 streams. In 2022 cumulatively racked up 4.723B plays on on-demand services (Spotify, YouTube Music, Apple Music, Amazon Music etc.) in 2022, down from the 5.274B streams the equivalent Top 10 shared in 2021. (Music Business Worldwide)

Crypto / NFT / Metaverse

-

Texas A&M University, the largest school in the US by number of students, added a Bitcoin Protocol class to its spring curriculum. The professor said the course will teach students how to “build a Bitcoin library from scratch.” (Coin Telegraph)

-

About 23% of game developers say that their studios are interested in Web3 technology, a slight decline from 27% last year. Over half of those developers (56%) weren't interested last year and aren't interested this year. (The Verge)

-

South Korea launched a metaverse replica of Seoul. As part of a three-year effort to expand its public services, Metaverse Seoul will let users take their avatars to tax offices, access youth counseling and read e-books. (Coindesk)

OTT / Streaming

-

YouTube TV is rolling out updates to its Live Guide and Library. The updated Live Guide now includes a row of curated recommendations at the top, a condensed grid that displays more channels and programming on the screen and an overall simpler design. (Tech Crunch)

-

Netflix has expanded its measurement deal with Nielsen, which now includes national TV program and streaming platform data in the United States. Under the terms of the deal, Netflix will now subscribe to Nielsen’s national TV service, receiving program specific level data, as well as streaming TV data. (Media Post)

-

Given over 60% of its global subscribers watched Korean content in 2022, Netflix showcased 34 Korean titles in its 2023 slate announcement, including 11 previously unknown projects. (THR)

-

The broadcasting rights for the next Olympic Games cycle are set to be shared between Warner Bros. Discovery and the European Broadcasting Union. The new rights agreement covers the 2026-2032 period, which includes the 2026 winter games in Italy and the 2028 summer games in L.A. (Variety)

-

YouTube is testing a new hub of free, ad-supported streaming channels. Adding a hub of free, ad-supported streaming TV channels, or FAST channels, would put it in competition with players such as Roku, Pluto TV and Tubi. (WSJ)

-

Netflix added 7.66M net new subscribers in Q4, compared to its own estimation of 4.5M additions. Subscriptions rose by 910K in the US and Canada, 3.2M throughout EMEA, 1.76M in LATAM and 1.8M in APAC. (Variety)

-

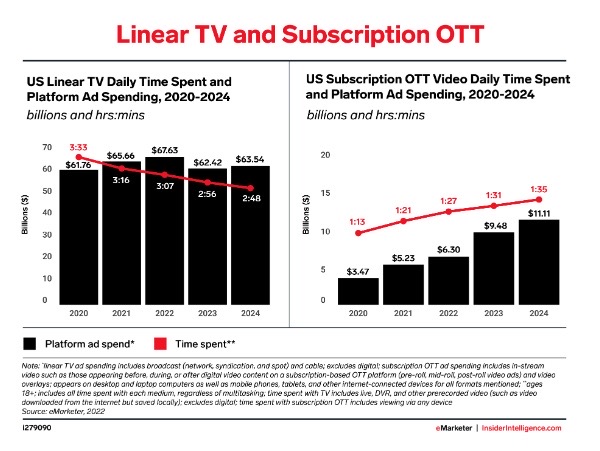

Insider released a list of OTT trends to expect this year. They expect non-pay TV households to outnumber pay TV households by about 5M and for subscription OTT streaming to reach half of time spent with linear TV in the US. (Insider)

-

In a survey of the US, France, and Germany, basic with Ads was Netflix's least popular tier, with the rest of respondents on its more expensive Standard (34%), Premium (27%), and Basic (25%) plans. (Insider)

-

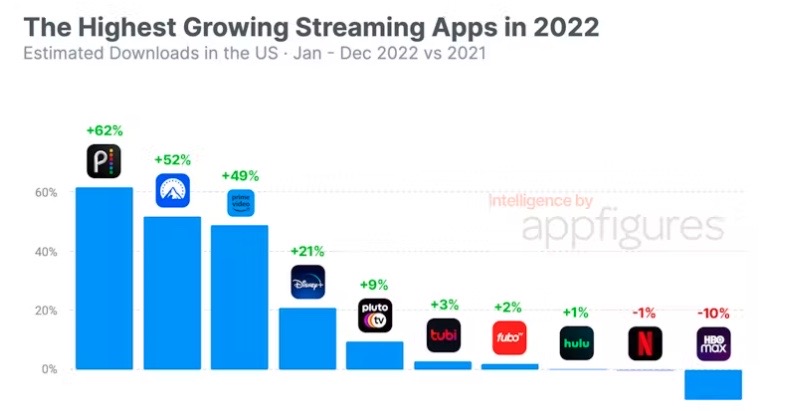

Peacock passed Disney+ to be the most downloaded streaming app in the US. Peacock's rise can be directly attributed to sports. In 2022, Peacock streamed the Super Bowl, the Summer Olympics, and wrapped up the year by streaming the World Cup. (Appfigures)

-

Amazon renames EPIX to MGM+ but will keep popular Epix shows like the Godfather of Harlem and From and launch many new shows like Murf The Surf, A Spy Among, and more. (CordCutterNews)

Retail / Lifestyle / Travel

-

Retail Dive released a list of trends that are expected to impact retail moving into 2023. Among them are bankruptcies, metaverse growth, and environmental focus. (Retail Dive)

-

British consumers cut their shopping in December by the most in at least 25 years due to inflation. Sales volumes were down by 5.8% YoY, the biggest fall for that month in records going back to 1997. (Reuters)

-

About 40% Chinese tourists don't plan to travel overseas this year. Health concerns, the inconvenience of applying for travel documents, busy work schedules, worries over safety and unfriendly destinations to Chinese were also among factors deterring overseas travel. (Bloomberg)

Social Media

-

Twitter users can have Twitter Blue for $84 annually if they get it on the web. The revamped Twitter Blue subscription was launched last December at a rate of $8 per month (or $11 per month for iOS users). (Tech Crunch)

-

Half of users’ time on Meta platforms is now spent on video. 140B Reels are shared every day, and the largest cohort among the site’s reach of 72% of the UK population specifically are in the 18-34-year-old demographic. (The Drum)

-

Twitter's daily revenue last Tuesday was 40% lower than the same day a year ago, underscoring the crisis facing its core ads business. 500 of its top advertisers have stopped spending on the platform amidst the Elon Musk takeover. (The Information)

-

Mastodon's active users jumped from about 500K before Elon Musk took control of Twitter to almost 2M active users in November. However, the number of active users on the Mastodon social network has dropped more than 30% since the peak and is continuing a slow decline. (The Guardian)

-

Instagram announced a new feature called “quiet mode,” which aims to help users focus and set boundaries with friends and followers. When the option is enabled, all notifications will be paused and the profile’s activity status will change to ‘In quiet mode.” (CNN)

-

The Australian Competition & Consumer Commission will be conducting sweep of social media influencer platforms to identify posts that contain potentially misleading reviews or testimonials, including omissions of disclosure of commercial relationships. (AdNews)

-

Time spent using social media apps rose to new highs in 2022, with Be Real being the breakout social sensation, promoting more authentic social content. No social app has added more new users in the US in any of the past five years than BeReal’s 5.3M in August 2022. (Social Media Today)

Sports

-

The NBA has signed a multiyear deal with consumer data firm StellarAlgo, with the league’s investment arm taking an ownership stake in the firm as it looks to grow its portfolio. The partnership brings franchises access to fan data services for matters such as e-commerce, venues, ticketing and social media. (Bloomberg)

-

HBO Max subscribers can now livestream US national soccer games. Along with live coverage of the matches, HBO Max will also give subscribers pre-game and post-game coverage, as well as replays. (Tech Crunch)

Video Games

-

Playtika Holding Corp. offered to buy Rovio Entertainment Oyj, the maker of the Angry Birds mobile games, in a deal valuing the company at about €750M ($810M). Rovio said it wasn’t presently engaged in talks with Playtika but would evaluate the proposal and determine how to proceed. (WSJ)

-

Microsoft's announcement of mass layoffs extended to its video game division, including the developers of hit titles such as Starfield and Halo. Some of those who lost their jobs were veterans who had been with Xbox for more than a decade. (Bloomberg)

-

The gaming industry is expected to be worth over $320B by 2026 and is already larger than Hollywood and the music industry combined. With approximately 2.9B active gamers in the world, brands can tap into and cultivate new customers from the engaged consumers who are loyal to franchises like Fortnite and Roblox. (Forbes)